You can know if your loan is a home equity line of credit by checking if it’s a revolving line of credit secured by your home’s equity. Look for variable interest rates and the ability to borrow and repay funds as needed.

Home equity lines of credit, or HELOCs, can provide a flexible source of funds for homeowners. They allow you to draw funds as needed, up to a certain limit, using your home as collateral. With a HELOC, you can borrow against the equity in your home and use the funds for various purposes, such as home improvements, debt consolidation, or unexpected expenses.

It’s important to understand the features and terms of your loan to make informed financial decisions.

Understanding The Difference Between A Heloc And A Traditional Loan

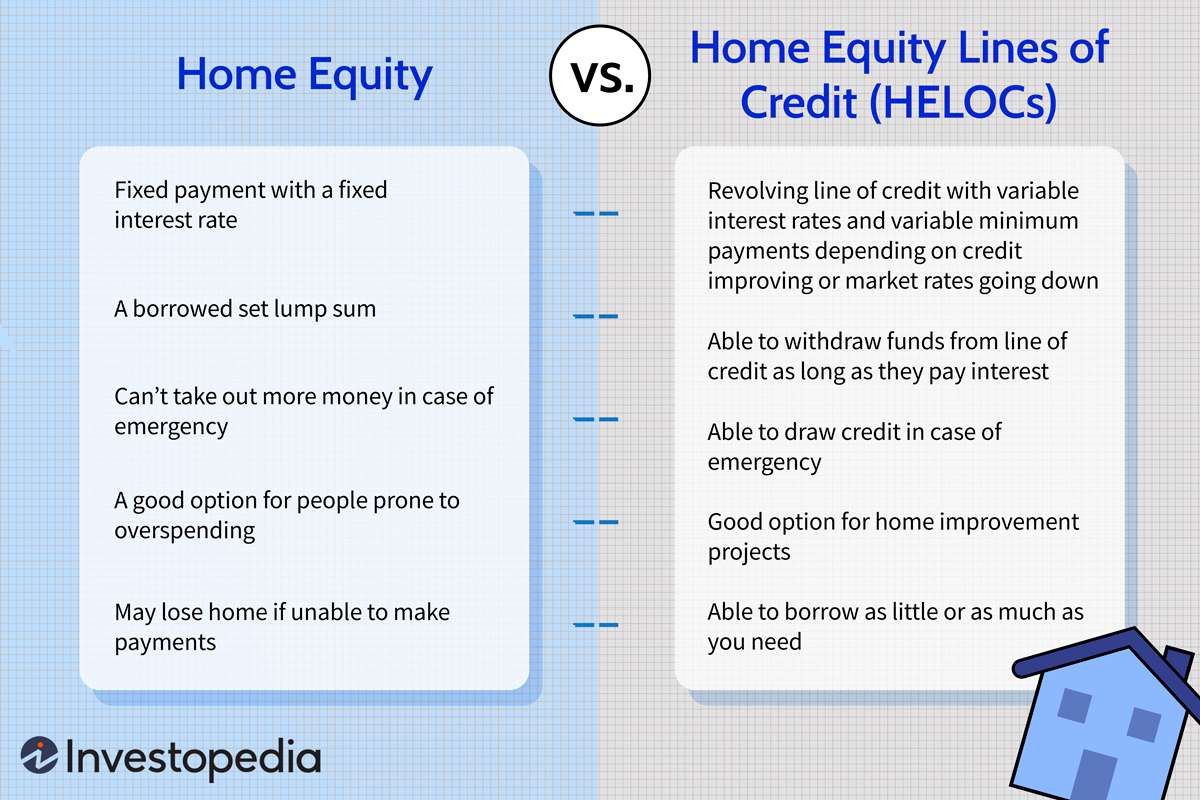

Confused about whether your loan is a home equity line of credit (HELOC) or a traditional loan? Understanding the difference is key. HELOCs offer a flexible borrowing solution against your home’s equity, while traditional loans provide a lump sum upfront.

Understanding the Difference Between a HELOC and a Traditional Loan HELOC vs. Traditional Loan: Repayment Repayment Terms A Home Equity Line of Credit (HELOC) offers flexible repayment terms compared to a traditional loan. HELOC allows borrowers to draw funds as needed, paying back only what is used. Interest-only Payments With a HELOC, borrowers can often make interest-only payments during the draw period, providing lower monthly payments initially. Fixed Payments Traditional loans usually have fixed monthly payments, making it easier to budget but offering less flexibility in repayment schedules. HELOC vs. Traditional Loan: Interest Rates Variable Rates HELOCs typically come with variable interest rates, which can lead to fluctuating monthly payments based on market conditions. Fixed Rates Traditional loans generally have fixed interest rates, providing predictability in monthly payment amounts throughout the loan term. HELOC vs. Traditional Loan: Flexibility Draw Period During the draw period of a HELOC, borrowers can withdraw funds multiple times up to the credit limit, offering flexibility in accessing cash. Fixed Amount In a traditional loan, borrowers typically receive a one-time lump sum, limiting the flexibility in utilizing funds based on immediate needs. Revolving Credit HELOCs operate as a revolving line of credit, allowing borrowers to borrow, repay, and borrow again throughout the draw period. Single Disbursement Traditional loans provide a single disbursement of funds at the beginning, with no option to access additional funds unless refinancing. By understanding the key differences in repayment terms, interest rates, and flexibility between a HELOC and a traditional loan, you can make an informed decision on which option best suits your financial needs.

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)

Credit: www.investopedia.com

How To Determine If Your Loan Is A HELOC

Homeowners often rely on different types of loans to finance renovations, pay off debt, or cover unexpected expenses. One common type of loan is a Home Equity Line of Credit (HELOC). But how do you determine if your loan is a HELOC? Here are some steps to help you uncover the answer.

Check Your Loan Agreement And Documentation

Review your loan agreement and any related documentation. Look for keywords and terms that indicate your loan is a HELOC. Pay attention to phrases such as “home equity line of credit,” “variable rate,” or references to a credit line. If you’re unsure, consider consulting with a financial advisor or mortgage professional to clarify the terms and features of your loan.

Contact Your Lender

If you’re still uncertain about the nature of your loan, reach out to your lender. Ask them directly if your loan is a Home Equity Line of Credit. Your lender should be able to provide you with detailed information about your loan’s structure, terms, and payment methods.

Review Your Monthly Statements

Examine your monthly statements for any indicators that your loan is a HELOC. Look for information such as “available credit,” “draw period,” or fluctuating interest rates. It’s important to thoroughly understand the terms and conditions associated with your loan to avoid any surprises.

Key Features And Terms Of A HELOC

A Home Equity Line of Credit (HELOC) is a type of loan that allows homeowners to borrow against the equity in their homes. It offers flexibility and can be a useful financial tool for homeowners. Understanding the key features and terms of a HELOC is essential when considering this type of financing.

Variable Interest Rates

A HELOC typically comes with a variable interest rate, meaning the interest rate can fluctuate over time based on market conditions. This can impact the overall cost of the loan and should be carefully considered before obtaining a HELOC.

Draw Period

During the draw period, which is typically 5 to 10 years, the borrower can access funds from the HELOC up to a predetermined credit limit. Interest payments are usually required during this period, and the borrower has the flexibility to borrow and repay as needed.

Repayment Period

After the draw period, the HELOC enters the repayment period, which can last up to 20 years. During this time, the borrower cannot draw additional funds and is required to make regular repayments, which may include both principal and interest.

Credit Limit

The credit limit of a HELOC is determined based on the borrower’s equity and creditworthiness. This limit represents the maximum amount that can be borrowed against the home’s equity. It’s important to be mindful of the credit limit when considering the potential borrowing capacity of a HELOC.

Credit: www.citizensbank.com

Steps To Take If Your Loan Is A HELOC

Discover whether your loan is a Home Equity Line of Credit (HELOC) by following these steps. Take a proactive approach to determine the type of loan you have and understand the options available to you.

Steps to Take If Your Loan is a HELOC Understand Your Responsibility as a Borrower As a borrower with a Home Equity Line of Credit (HELOC), educating yourself on the terms and conditions is crucial. Utilize the Line of Credit Wisely Use the funds sensibly to avoid piling up unnecessary debt. Stick to your financial goals. Create a Repayment Plan Develop a clear payment strategy to ensure you can pay off the HELOC balance in a timely manner. Monitor Your Credit and Interest Rates Regularly check your credit score and keep an eye on any fluctuations in the interest rates. In summary, a HELOC can be a valuable financial tool if managed correctly.

Credit: www.nerdwallet.com

Frequently Asked Questions For How Do You Know If Your Loan Is A Home Equity Line Of Credit

What Is A Home Equity Line Of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a type of loan that allows homeowners to borrow against the equity they have in their home. It provides a revolving credit line that can be accessed as needed, making it a flexible option for financing home improvements, debt consolidation, or other expenses.

How Do I Know If I Have A Home Equity Line Of Credit?

To determine if your loan is a Home Equity Line of Credit (HELOC), review the terms and conditions of your loan agreement. Look for language that specifically mentions a line of credit or equity borrowing. Additionally, check your statements or contact your lender to confirm the details of your loan.

What Are The Advantages Of A Home Equity Line Of Credit?

A Home Equity Line of Credit (HELOC) offers several advantages. It often has lower interest rates compared to traditional loans, provides flexibility in borrowing amounts, and can be used for various purposes. Additionally, the interest paid on a HELOC may be tax-deductible, making it a financially advantageous option for certain individuals.

Can I Use A Home Equity Line Of Credit For Any Purpose?

Yes, you can use a Home Equity Line of Credit (HELOC) for a variety of purposes. Whether you need to finance a home renovation, pay for education expenses, or consolidate high-interest debt, a HELOC provides the flexibility to access funds as needed.

However, it is important to use the funds responsibly and consider the potential risks involved.

Conclusion

To sum up, understanding the key indicators of a home equity line of credit is crucial. By recognizing the features and terms specific to a HELOC, you can make informed decisions and effectively manage your finances. Stay vigilant and seek professional advice for navigating the complexities of loan options.