To get the most out of a payday loan, carefully assess your financial needs, borrow only what is necessary, and make timely repayments to avoid additional fees and interest. Payday loans should be a last resort due to their high interest rates and short repayment terms.

When facing unexpected financial challenges, payday loans can provide a quick solution. However, if not managed properly, they can lead to a cycle of debt. By understanding the terms, borrowing responsibly, and using the funds for essential expenses only, you can make the most of a payday loan.

It’s important to consider alternative options and seek financial counseling if you find yourself relying on payday loans frequently. This approach will help you avoid falling into a pattern of debt and achieve better financial stability.

Choosing The Right Payday Loan

When it comes to payday loans, choosing the right one is essential to ensure you get the most out of your borrowing experience. Evaluating your needs, researching lenders, comparing interest rates, and considering repayment terms can help you make an informed decision.

Evaluate Your Needs

- Determine the exact amount you need to borrow.

- Assess your repayment capability to avoid overborrowing.

- Identify the urgency of your financial needs.

Research Lenders

- Look for reputable lenders with a history of positive customer feedback.

- Check for accreditations and licenses to ensure legitimacy.

- Read reviews and testimonials to gauge the lender’s reliability.

Compare Interest Rates

- Review the APR offered by different lenders to find the most competitive rate.

- Understand the total cost of borrowing, including fees and charges.

- Choose a lender that offers transparent and fair interest rates.

Consider Repayment Terms

- Assess the flexibility of repayment schedules provided by each lender.

- Ensure the repayment terms align with your financial situation and budget.

- Avoid lenders with rigid repayment terms that may lead to financial strain.

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Credit: www.investopedia.com

Understanding The Terms And Conditions

To make the most of a payday loan, it’s crucial to fully comprehend the terms and conditions before proceeding. By carefully reviewing the details, borrowers can understand the repayment schedule, interest rates, and any potential fees, ultimately ensuring a beneficial borrowing experience.

Understanding the terms and conditions of a payday loan is crucial to make informed financial decisions. When considering a payday loan, it’s essential to be well-versed in the loan’s terms and conditions to avoid potential pitfalls. Here’s how to navigate and comprehend the terms and conditions effectively. Know the Interest Rate Before agreeing to a payday loan, understanding the interest rate is imperative. The interest rate determines the cost of borrowing and directly impacts the total amount repayable. Be sure to carefully evaluate and comprehend the interest rate to assess the affordability of the loan. Understand the Repayment Schedule Familiarize yourself with the repayment schedule, including the due date and the total amount due. Understanding the repayment plan helps in planning and budgeting your finances accordingly. It’s crucial to ensure that the repayment schedule aligns with your pay cycle to avoid any potential late payment penalties. Be Aware of Hidden Fees Be vigilant and proactive in identifying any hidden fees associated with the payday loan. Hidden fees could include origination fees, processing fees, or prepayment penalties. Understanding and being aware of these additional costs will prevent any surprises and help calculate the actual cost of the loan accurately. Read the Fine Print When reviewing the terms and conditions, it’s essential to read the fine print meticulously. Pay close attention to any clauses or conditions that may have a significant impact on the borrowing experience. Understanding the fine print helps in making informed decisions and prevents any misunderstandings or disputes in the future. By understanding these vital aspects of the terms and conditions associated with a payday loan, borrowers can make informed decisions and maximize the benefits while avoiding potential pitfalls. Always approach payday loans with caution and ensure full understanding of the terms and conditions before proceeding with the borrowing agreement.

Managing Your Finances

Managing your finances is crucial when considering a payday loan. By implementing effective strategies, you can maximize the benefits of a payday loan while avoiding financial pitfalls. Here are some essential steps to help you manage your finances effectively:

Create A Budget

Creating a budget is the first step towards financial stability. Start by listing your monthly income and expenses. Allocate funds for necessities such as rent, utilities, groceries, and transportation. Identify areas where you can cut back on expenses to free up funds for loan repayment.

Determine Loan Affordability

Assessing loan affordability is critical to avoid overextending your finances. Calculate the maximum amount you can comfortably repay without compromising your essential expenses. Consider the loan terms and interest rates to determine the total cost of borrowing and ensure it aligns with your budget.

Avoid Overborrowing

Avoid overborrowing to mitigate the risk of falling into a cycle of debt. Only request the amount you need to address urgent financial needs. Resist the temptation to borrow additional funds for non-essential expenses, as it can lead to financial strain and difficulty in repayment.

Prioritize Repayment

Prioritize loan repayment to minimize the impact on your finances. Allocate a portion of your income specifically for loan repayment to ensure timely and complete settlement. Making timely payments not only reduces the overall cost of the loan but also helps bolster your credit score.

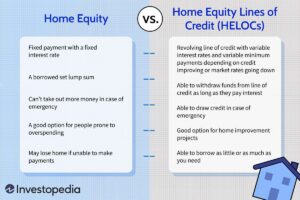

Credit: www.ngpf.org

Applying For A Payday Loan

When you need quick cash in emergencies, a payday loan can be a lifesaver. The process of applying for a payday loan is straightforward and convenient. Here’s how you can efficiently navigate through the application process:

Gather The Necessary Documents

Before you begin your payday loan application, make sure you have the required documents in hand. These typically include your ID, proof of income, and bank statements.

Complete The Application

Fill out the payday loan application form accurately and honestly. Double-check all the information provided to avoid delays in the approval process.

Submit The Application

Once you’ve completed the application, submit it through the lender’s online platform or in-person at a physical location. Ensure all the necessary details are included.

Wait For Approval

After submitting your application, patiently wait for the lender to review it. This process typically takes a short amount of time. Stay connected for updates on your approval status.

Using The Funds Wisely

To make the most of a payday loan, it’s essential to utilize the funds wisely for pressing financial needs. Prioritize essential expenses to ensure the loan provides maximum assistance without creating additional financial strain. Tracking spending and budgeting effectively can help optimize the loan’s benefits.

Using the Funds Wisely When it comes to payday loans, it’s crucial to use the funds wisely to avoid falling into a cycle of debt. Payday loans are designed to provide quick cash solutions during emergencies or unexpected financial situations. To get the most out of a payday loan, it’s important to allocate the funds responsibly and strategically. In this article, we will explore three essential ways to make the most of your payday loan.

Cover Essential Expenses

One of the primary reasons people consider payday loans is to cover essential expenses. It’s vital to prioritize your needs and use the funds to meet these obligations. From rent or mortgage payments to utility bills and groceries, consider using the payday loan to ensure these expenses are taken care of. This ensures that you can maintain your standard of living and avoid any potential repercussions from missed payments.

Pay Off Outstanding Debts

Another way to utilize a payday loan effectively is by paying off outstanding debts. If you have credit card bills, medical expenses, or other debts with high-interest rates, using a payday loan to settle them can be a wise decision. By consolidating your debts and opting for a payday loan, you can reduce the burden of multiple payments and potentially save money on interest charges in the long run.

Emergency Situations

Life is full of unexpected emergencies, such as medical emergencies or car repairs. Payday loans can come to your rescue during these situations, providing you with the necessary funds quickly. If you find yourself in such an emergency, consider using a payday loan to handle the immediate expenses. However, it’s important to remember that payday loans should only be a short-term solution and should not be relied upon for long-term financial needs.

Avoid Impulse Spending

While payday loans offer quick access to cash, it’s crucial to resist the temptation of using the funds for unnecessary and impulsive purchases. Avoid the urge to splurge on non-essential items that won’t contribute to your financial stability. Instead, prioritize your financial well-being and use the loan for crucial expenses or to pay off outstanding debts. In conclusion, payday loans can provide a temporary solution during financial emergencies. By using the funds wisely, you can cover essential expenses, pay off outstanding debts, and handle emergency situations. Remember to avoid impulse spending and prioritize your financial priorities when considering a payday loan.

Avoiding The Cycle Of Debt

Learn how to maximize the benefits of payday loans and break free from the cycle of debt. Discover practical strategies to make the most of these short-term loans without getting trapped in a never-ending cycle of borrowing.

Payday loans can provide quick financial relief when you are in a tight spot. However, if not managed properly, they can lead to a cycle of debt that is difficult to break free from. To ensure you get the most out of your payday loan without falling into this trap, here are some key strategies to follow:

Borrow Only What You Need

When it comes to payday loans, it’s vital to exercise restraint and borrow only what you really need. Avoid the temptation to borrow more than necessary, as it will only increase your debt burden and make repayment more challenging.

Create A Repayment Plan

Having a clear and realistic repayment plan is essential to avoid falling into a cycle of debt. Before taking out a payday loan, calculate your monthly income and expenses to determine the amount you can comfortably repay. By setting aside a specific portion of your income each month for loan repayment, you can ensure that you stay on track and avoid late payment penalties.

Avoid Rollovers

When a payday loan is due and you are unable to repay it in full, some lenders offer the option to roll over the loan. However, this convenience comes at a cost. Rollovers usually come with additional fees and higher interest rates, which can significantly increase the overall amount you owe. It is best to avoid this option if possible and focus on repaying the loan on time.

Seek Financial Counseling

If you find yourself struggling with payday loan debt or facing financial difficulties in general, seeking professional advice from a financial counselor can be invaluable. They can help you analyze your financial situation, provide guidance on budgeting and debt management, and offer personalized solutions to help you break free from the cycle of debt. Remember that payday loans should be used only as a temporary financial solution and not as a long-term means of managing your finances. By following these strategies, you can be proactive in avoiding the cycle of debt and making the most out of your payday loan.

Understanding The Risks

High Interest Rates

Payday loans come with exceptionally high interest rates, typically ranging between 300% to 500% APR.

Potential For Collection Actions

Failure to repay a payday loan can lead to aggressive collection actions, including debt collectors contacting you frequently.

Impact On Credit Score

Defaulting on a payday loan can severely impact your credit score, making it difficult to access credit in the future.

Dependency On Payday Loans

Relying on payday loans regularly can create a cycle of debt, leading to financial instability in the long run.

Credit: www.fool.com

Exploring Alternatives

When exploring alternatives to payday loans, there are several options you can consider to meet your financial needs without resorting to high-interest borrowing.

Personal Loans

If you have a good credit score, you may qualify for a personal loan from a bank or online lender. These loans typically offer lower interest rates and longer repayment terms than payday loans, making them a more affordable option. Compare different lenders and their terms to find the best deal.

Credit Union Loans

Many credit unions offer small-dollar loans to their members at competitive rates. These loans often come with more favorable terms and lower fees than payday loans. Contact your local credit union to inquire about their loan options and eligibility requirements.

Borrowing From Family Or Friends

Consider asking family or friends for a loan to avoid the high costs associated with payday loans. Be honest about your financial situation, agree on repayment terms, and treat the loan as a formal agreement to maintain trust in the relationship.

Negotiating With Creditors

If you are struggling to meet your existing financial obligations, reach out to your creditors to explore the possibility of renegotiating payment terms or establishing a more manageable repayment plan. Many creditors are willing to work with you to find a solution that suits your circumstances.

Frequently Asked Questions On How To Get The Most Out Of Payday Loan

How Do Payday Loans Work?

Payday loans are short-term loans that allow you to borrow a small amount of money and repay it on your next payday. The application process is simple and quick, and funds are usually deposited into your bank account within a few hours.

However, it’s important to note that payday loans come with high interest rates, so it’s crucial to repay them on time to avoid additional fees.

Are Payday Loans A Good Option For Emergencies?

Payday loans can be a good option for emergencies if you need cash quickly and have no other alternatives. However, it’s important to consider the high interest rates and fees associated with payday loans. Before taking out a payday loan, explore all other options, such as borrowing from friends or family, negotiating with creditors, or seeking assistance from a financial counselor.

What Are The Alternatives To Payday Loans?

If you’re in need of emergency funds but want to avoid payday loans, consider these alternatives. First, check if you qualify for a personal loan from your bank or credit union. You can also explore borrowing from friends or family, utilizing a credit card cash advance, or even selling some of your belongings.

Additionally, some nonprofits and community organizations offer emergency assistance programs.

How Can I Avoid The Cycle Of Payday Loan Debt?

To avoid getting trapped in the cycle of payday loan debt, it’s important to have a solid plan in place. Start by creating a budget to ensure you can meet your financial obligations and cover unexpected expenses. If you find yourself relying on payday loans frequently, consider seeking help from a financial counselor who can provide guidance on managing your finances and finding alternatives to payday loans.

Conclusion

Utilizing payday loans wisely can help in times of financial need. Remember to borrow only what you can afford to repay promptly. Prioritize repayment to avoid spiraling debt. Keep transparency with lenders and seek financial advice if overwhelmed. Stay informed and make informed decisions.