The achievement of financial stability and security depends on effective personal money management. Effective strategies include budgeting, saving, investing, and managing debt.

Getting through the complexity of personal finance may be a rewarding and difficult endeavor. Understanding the essentials of money management forms the cornerstone of a secure financial future. Careful budgeting and regular savings contribute significantly to withstanding economic uncertainties. Smart investing decisions can lead to wealth accumulation, enabling you to reach long-term goals such as retirement or buying a home.

Equally important is managing debt responsibly to maintain a healthy credit score, thus ensuring easier access to loans with favorable terms. Tailoring these principles to your individual circumstances can mark the difference between financial success and hardship. Engaging with financial literacy resources and consulting professionals when needed are advised to stay on the right path.

The Rise Of Financial Literacy

Financial literacy rises as more people learn about money. Knowing about finances means power. It lets you make smart choices. From saving to investing, knowledge is key.

A New Era Of Money Management

We are in a new era of managing money. People learn about finances in school. They also learn from apps and online courses. Everyone can now be a money expert.

- Learning to budget early.

- Understanding debts and investments.

- Making informed financial choices.

Embracing Technology In Personal Finance

Technology changes how we handle money. We pay, save, and invest with apps. It’s easy and fast. Security is also better. We keep money safe while we learn.

| Benefits of Tech in Finance | Examples |

|---|---|

| Convenience | Mobile Banking |

| Learning | Financial Planning Apps |

| Security | Biometrics |

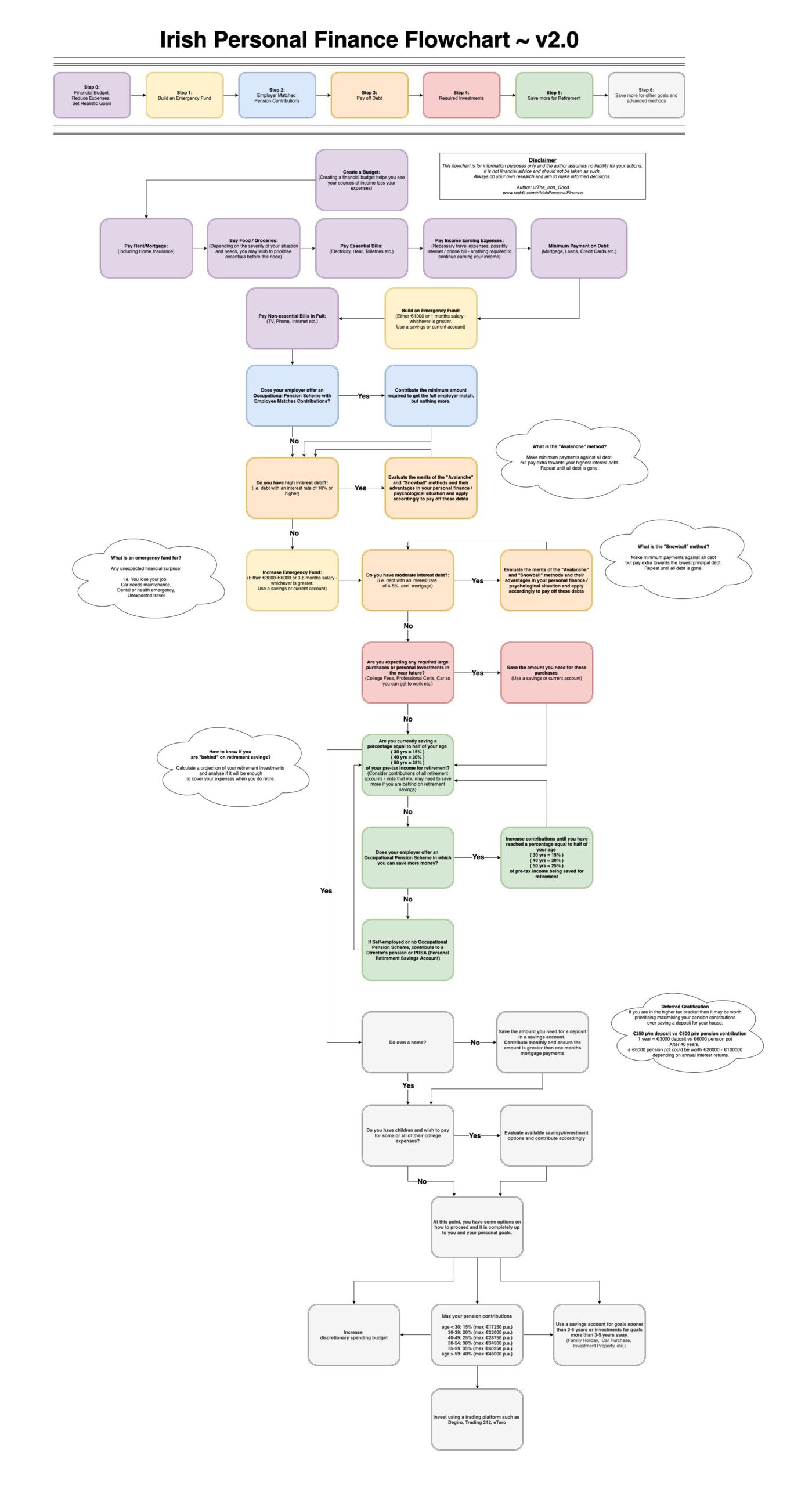

Credit: www.reddit.com

Budgeting Basics

Welcome to the ‘Budgeting Basics’ section of our blog. Mastering budgeting is key to maintaining financial health. Let’s dive into the essentials of creating a budget that works for you and explore the tools that can help manage your finances effectively.

Creating A Sustainable Budget

To start, assess your income and expenses. Note down all income sources. List fixed and variable expenses. Doing this helps you visualize cash flow. Focus on needs before wants to ensure that essential costs are covered, and aim to save a portion of income regularly.

Implement the 50/30/20 rule to guide spending:

- 50% on necessities like housing and groceries

- 30% on wants such as entertainment

- 20% towards savings or debt repayment

Adjust this framework to fit personal financial goals. Consistently review and adjust the budget to reflect actual spending habits and to address any changes in income or expenses.

Tools And Apps For Effective Budgeting

Digital tools make budgeting simpler and more accurate. Use apps to track spending, set reminders for bills, and get reports on financial progress.

Some popular budgeting tools include:

| App | Features |

|---|---|

| Mint | Expense tracking, bill reminders |

| YNAB (You Need A Budget) | Personalized budgeting, goal setting |

| Personal Capital | Investment tracking, wealth management |

Before selecting an app, consider privacy and security features. Ensure it meets personal budgeting styles and financial objectives. Benefit from the flexibility and control these digital aids offer to take charge of personal finances.

Debt Management Strategies

Managing debt can feel like a tricky puzzle.

But with the right strategies, you can pay off loans and live a stress-free financial life.

Learn how to distinguish between good and bad debt. Discover proven methods to reduce what you owe.

Identifying Good Vs. Bad Debt

To manage debt, know its types.

Good debt helps you grow financially. Bad debt can hold you back.

| Good Debt | Bad Debt |

|---|---|

| Student loans | Credit card debt |

| Mortgages | High-interest loans |

Steps To Tackle Outstanding Debts

Follow these steps to take control:

- Outline your debts: List them all with details.

- Set priorities: Which costs more over time?

- Create a budget: Plan your spending wisely.

- Build an emergency fund: Avoid new debt.

- Consider consolidation: One payment might be easier.

- Stay focused: Keep your financial goal in mind.

Be patient and consistent.

Financial freedom is within your reach.

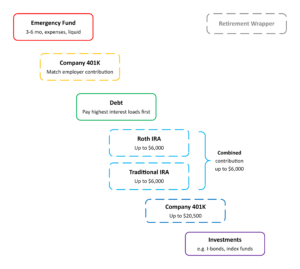

Credit: www.financiallyalert.com

Investment Options For The Savvy Saver

Smart savers know that just saving money isn’t enough. Investment options can grow your savings faster. Let’s dive into ways to make your money work for you.

Assessing Risk And Reward

Knowing where to invest starts with understanding the balance between risk and reward. A higher potential return often means higher risk. Take a look at different investment types:

- Stocks: Ideal for high rewards but come with higher risks.

- Bonds: Offer steady income with lower risk than stocks.

- Certificates of Deposit (CDs): Safe, low-risk, but offer smaller returns.

Select an investment that matches your comfort with risk and your financial goals.

Diversification: The Key To A Healthy Portfolio

Diversification spreads your investments across different assets. This can lower your overall risk. Create a mix of investment options:

| Investment Type | Risk Level | Potential Return |

|---|---|---|

| Equities | High | High |

| Bonds | Medium | Medium |

| Money Market Funds | Low | Low |

A well-diversified portfolio can help you weather market ups and downs.

Planning For The Future

Planning for the Future is about making smart choices now. It sets you up for a happy, secure life later. Think of it like planting a garden. You sow seeds today and take care of them. Then, you enjoy the flowers or fruits down the road. Planning ensures you’re ready for whatever comes. Whether that’s buying a home, sending kids to college, or living comfortably when you no longer work. It’s about knowing your future self will thank you for the decisions you make today.

Retirement Savings Plans

Saving for retirement is like building your dream house. You need a good plan, strong materials, and a reliable team. Explore different savings options early.

- 401(k)s and IRAs are the bricks and mortar of the savings world. These plans offer tax advantages that help your savings grow faster.

- Employer matching is your secret weapon. If your job offers it, always contribute enough to get the full match. It’s free money!

- Start saving as soon as you can. Even small amounts add up. The earlier you start, the more time your money has to grow.

Navigating The World Of Insurance

Insurance protects you like a sturdy roof during a storm. It helps keep you safe when bad things happen. There are many types to consider:

Health insurance is a must. It’s like having a first-aid kit. You hope not to need it, but it’s there just in case.

Life insurance is another key part. It’s a promise that your family will have support even if you can’t be there for them.

Disability and long-term care insurance are safety nets as you get older. These plans help cover costs if you need help taking care of yourself.

Understand what each policy offers. Check what’s covered and what’s not. This way, you pick the right coverage for you and your family.

Maximizing Income Streams

Understanding how to maximize income is critical for financial growth. A diverse range of income sources can bolster financial security. Let’s explore effective ways to enhance your earning potential.

Side Hustles And Passive Income

Earning money outside your main job offers financial cushioning. Side hustles align with personal skills and passions. Passive income generates earnings with minimal ongoing effort. Below are strategies to consider:

- Freelancing: Use platforms like Upwork or Fiverr for gigs.

- E-commerce: Sell products online with Shopify or Etsy.

- Renting Out Property: Consider Airbnb to rent a room or your entire home.

- Investments: Earn from stocks, bonds, or dividend-paying assets.

Automation and scaling matter. Automate processes and expand offerings to grow your passive income.

Negotiating Salaries And Benefits

Don’t underestimate the power of negotiation. Secure higher earnings and better benefits with these tips:

- Research Market Rates: Know the worth of your role.

- Highlight Achievements: Showcase your value to the company.

- Consider Perks: Health insurance, retirement plans, or bonuses.

- Practice Negotiation: Role-play discussions to gain confidence.

Regularly review salary benchmarks. Schedule discussions to negotiate terms, adjusting for inflation and living costs.

Tax Planning And Efficiency

Tax planning is key for keeping more of your hard-earned money. Smart strategies ensure you pay only what you owe, not a penny more. Getting to grips with how taxes work can lead to big savings. Let’s dive into the world of tax efficiency.

Understanding Tax Brackets

Tax brackets can be tricky. They tell you what rate of tax you’ll pay on different chunks of income. Knowing which bracket you’re in helps you plan better.

Additional rows omitted for brevity| Income Range | Tax Rate |

|---|---|

| $0 to $9,875 | 10% |

| $9,876 to $40,125 | 12% |

Strategies To Minimize Tax Liability

To save on taxes, smart moves are essential. Here are proven ways to cut your bill:

- Contribute to retirement plans: These lower your taxable income.

- Use Health Savings Accounts (HSAs): Set money aside tax-free for medical costs.

- Look for tax credits: They reduce your tax dollar-for-dollar.

- Invest in tax-efficient funds: They often have lower turnover rates.

Plan your donations too. Giving to charity can earn you a deduction. Make sure to keep records!

For families, consider tax benefits. Child credits and education savings plans are there to help.

Moreover, timing matters. Sometimes, delaying income or speeding up deductions can pay off.

Life’s Financial Milestones

Money plays a crucial part in our journey through life. Understanding financial milestones helps us make smarter choices. From settling down in a new home to gearing up for big events, each step requires careful planning. Let’s explore how to best approach these significant moments.

Buying Vs. Renting A Home

The decision between buying or renting a home is a major financial milestone. It affects your finances for years to come.

| Buying | Renting |

|---|---|

| Builds equity over time | Flexible, less commitment |

| Long-term financial benefit | Lower upfront costs |

| Potential for property value increase | Easy to move if needed |

When making a decision, take your long-term objectives and financial security into account. Every choice has advantages and disadvantages. Choose the one that best suits your lifestyle and budget.

Preparing For Major Life Events

Life’s big moments often come with a price tag. Being prepared can ease financial stress. Here’s a quick guide:

- Weddings: Save early, set a budget, and stick to it.

- Education: Consider saving plans like a 529 college savings plan.

- Retirement: Start a retirement fund as early as possible. Compound interest works wonders.

- New Family Members: Budget for prenatal care to childcare costs.

Each event requires a unique approach to saving and spending. Plan ahead and set aside funds to avoid financial pressure when these events unfold.

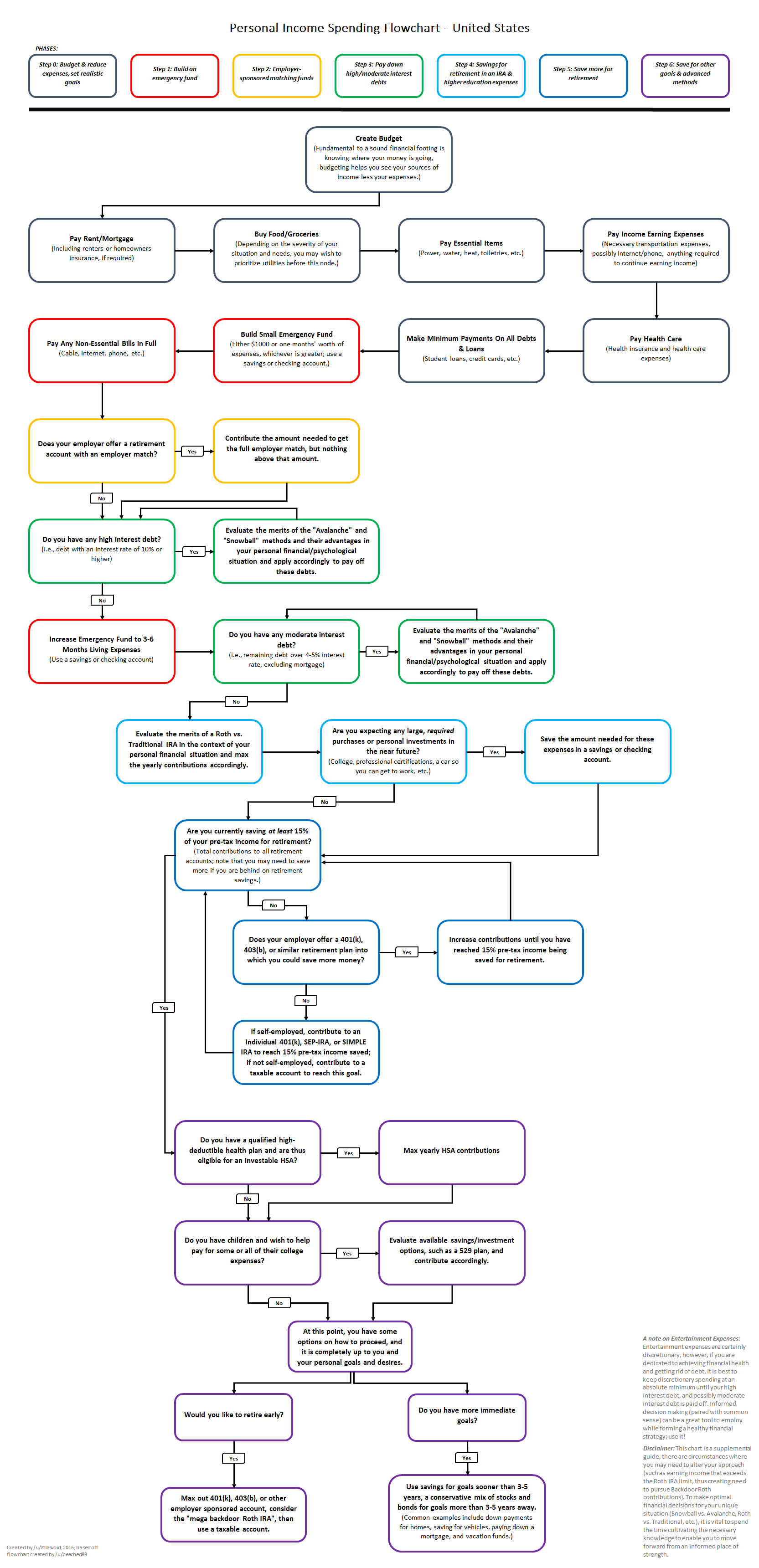

Credit: twitter.com

Frequently Asked Questions Of R Personal Finance

How Can I Start With Personal Finance In R?

Starting with personal finance in R involves installing relevant packages like `quantmod`, `PerformanceAnalytics`, and learning to import financial data. Begin by practicing data analysis and visualization with R’s robust toolset.

What Are The Best R Packages For Financial Analysis?

Key R packages for financial analysis are `quantmod` for market data, `TTR` for technical trading rules, `PerformanceAnalytics` for performance and risk analysis, and `PortfolioAnalytics` for portfolio optimization.

Can R Handle My Personal Budgeting Needs?

Yes, R has powerful packages like `ggplot2` for visualizing spending trends and `dplyr` for budget data management. Customize analyses to gain insights into your personal finances and optimize your budget.

How Does R Help In Financial Decision-making?

R assists in financial decision-making by providing in-depth data analysis, predictive modeling capabilities, and visualization tools. It allows for evidence-based conclusions, which are essential in making informed financial choices.

Conclusion

Navigating personal finance can be intricate. With the insights from our ‘R Personal Finance’ blog post, your journey to financial savvy is clearer. Arm yourself with this knowledge, make informed decisions, and optimize your monetary well-being. Start shaping your fiscal future today—your wallet will thank you tomorrow.