Personal finance is dependent upon your behavior because it influences your spending, saving, and investing decisions. It directly impacts your financial stability and future goals.

Your behavior dictates how you manage money, make financial choices, and plan for the long term. It influences your ability to stick to a budget, avoid unnecessary expenses, and prioritize savings. By understanding and adjusting your behavior, you can improve your financial situation and achieve your desired financial outcomes.

When it comes to personal finance, your behavior plays a pivotal role in determining your financial success. Your decisions and actions, such as spending habits and saving discipline, directly impact your financial well-being. Understanding the significance of behavior in personal finance is crucial for making informed decisions and managing your money effectively. It’s essential to recognize the connection between behavior and financial outcomes, as it empowers you to take control of your finances and work towards your financial goals. A proactive approach towards understanding and optimizing your behavior is key to securing a stable financial future.

Factors Influencing Personal Finance

Your financial choices heavily impact your personal finances. Your behavior towards spending, saving, and investing determines your overall financial well-being. By making informed decisions and cultivating good money habits, you can achieve financial success.

Personal finance is greatly influenced by various factors that shape our financial behavior. The way we spend, save, and manage our money can have a significant impact on our financial well-being. By understanding these factors and making conscious decisions, we can take control of our personal finances and pave the way for a more secure future.

Spending Habits

Our spending habits play a crucial role in our financial situation. The daily choices we make, whether it’s buying a cup of coffee or splurging on a luxury item, can have long-term consequences. It’s important to develop healthy spending habits that align with our financial goals.

Poor spending habits can lead to debt, overspending, and financial stress. By adopting a mindful approach to spending, we can allocate our money wisely and prioritize our needs over wants. This involves creating a budget, tracking expenses, and distinguishing between essential and non-essential purchases.

Savings Behavior

Savings behavior is another key factor in personal finance. Saving money is the foundation for building financial security and achieving long-term goals. However, it requires discipline and a commitment to delay gratification.

Individuals who prioritize saving and consistently contribute to their savings accounts are more likely to have a safety net during unexpected events or emergencies. They are also better positioned to achieve their financial milestones, such as buying a home or retiring comfortably. On the other hand, those who fail to save may experience financial instability and struggle to meet their financial commitments.

To cultivate healthy saving habits, it’s crucial to set clear savings goals, automate savings, and reduce unnecessary expenses. By making saving a priority, we can establish a strong financial foundation and work towards a prosperous future.

Credit: www.reddit.com

Psychological Aspect Of Personal Finance

Understanding the psychological aspect of personal finance is crucial in managing one’s financial well-being. It’s not just about numbers on a balance sheet; it’s about the behaviors and emotions that drive our financial decisions.

Behavioral Economics

Behavioral economics delves into the way individuals make financial choices and how their behaviors influence these decisions. It blends insights from psychology and economics to comprehend why people sometimes make less rational financial decisions. Understanding behavioral economics can help individuals recognize and modify their financial behaviors to achieve better outcomes.

Emotional Spending

Emotional spending is a common behavioral tendency where individuals make impulse purchases driven by feelings rather than necessity. This can lead to financial strain and hinder long-term financial goals, making it essential to address and manage emotional spending habits.

Impact Of Behavior On Financial Goals

Personal finance is heavily dependent on individual behavior. The way you manage your money, spend it, and make financial decisions has a direct impact on your financial well-being. Your behavior shapes your financial goals and determines whether you achieve them. Let’s delve into the crucial influence of behavior on various aspects of personal finance, particularly goal setting and long-term planning.

Goal Setting

One of the key components of personal finance is goal setting. Your financial objectives outline what you aspire to accomplish in the short, medium, and long term. However, achieving these goals hinges on your behaviors and habits. For instance, saving regularly and spending sensibly are behaviors that can propel you toward your financial targets.

Long-term Planning

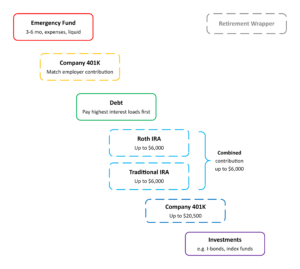

Effective long-term planning is essential for securing your financial future. This involves investing, retirement planning, and wealth accumulation. Disciplined behaviors like regularly contributing to retirement accounts, diversifying investments, and avoiding debt accumulation are critical for long-term financial success. Your behavior today has a profound impact on your financial stability years down the line.

Strategies For Positive Financial Behavior

When it comes to personal finance, your behavior plays a crucial role in determining your financial well-being. Your financial decisions and habits can directly impact your ability to achieve your financial goals and secure a stable future. By adopting positive financial behaviors, you can take control of your finances and build a strong foundation for financial success.

Budgeting Techniques

Budgeting is an essential skill that allows you to manage your income and expenses effectively. It helps you track your spending, prioritize your financial goals, and avoid unnecessary debt. Implementing the following budgeting techniques can lay the groundwork for positive financial behavior:

- Create a realistic budget: Start by analyzing your monthly income and expenses. Set aside a portion of your income for your needs, such as housing, food, and utilities. Allocate a percentage for savings and investments, and leave some room for discretionary expenses.

- Track your expenses: Keep a record of your daily expenses to get a clear understanding of where your money is going. Use apps or spreadsheets to monitor your spending habits and identify areas where you can make adjustments.

- Avoid impulsive purchases: Before making a purchase, evaluate whether it aligns with your budget and financial goals. Practice self-discipline by distinguishing between needs and wants, and limit unnecessary expenditures.

Debt Management

Debt can easily become a burden if you don’t manage it wisely. Taking control of your debt and adopting smart strategies for debt management can help you alleviate financial stress and build a stronger financial future. Consider the following techniques:

- Pay off high-interest debt first: Prioritize paying off debts with high interest rates to reduce the overall amount you owe. By focusing on these debts, you can save money on interest payments and ultimately become debt-free faster.

- Create a debt repayment plan: Develop a structured plan to pay off your debts systematically. Consider strategies like the snowball method, where you pay off the smallest debts first, or the avalanche method, which prioritizes debts with the highest interest rates.

- Seek professional help if needed: If you find yourself struggling to manage your debt, don’t hesitate to seek guidance from financial advisors or credit counselors. They can provide expert advice tailored to your unique situation.

By implementing these strategies for positive financial behavior, you can pave the way for a secure financial future. Whether it’s budgeting effectively or managing your debts wisely, your behaviors and choices determine the trajectory of your personal finance journey. Take control of your financial life today!

Changing Financial Behavior

Building Financial Discipline

Start by creating a budget to track spending habits.

- Avoid impulsive purchases.

- Set savings goals.

Seeking Professional Help

Consider consulting a financial advisor for guidance.

- Receive personalized advice on investments.

- Develop a comprehensive financial plan.

Remember, your financial behavior greatly impacts your overall financial health.

Credit: medium.com

Credit: www.cantechletter.com

Frequently Asked Questions On Why Is Personal Finance Dependent Upon Your Behavior

How Does Your Money Personality Affect Your Spending Behavior?

Your money personality significantly impacts your spending habits. Understanding your money personality helps determine whether you tend to be a saver or a spender. This knowledge empowers you to make more informed decisions and develop strategies that align with your financial preferences and goals.

Is Personal Finance More About Numbers Or Behavior?

Personal finance is about both numbers and behavior. While numbers matter for planning, behavior affects how we earn, spend, and save money. Both are crucial for financial success.

How Does Personal Finance Impact Your Life?

Personal finance impacts your life by shaping your financial stability, opportunities for investments, and overall lifestyle choices. It influences your ability to achieve your goals and aspirations, manage unexpected expenses, and attain financial security for yourself and your family.

Why Do You Think Personal Finance Is Important?

Personal finance is important because it helps you manage money effectively, achieve financial goals, and have a secure future. It enables you to save, invest, and plan for emergencies, ensuring financial stability and peace of mind.

Conclusion

To summarize, our personal finances are undeniably intertwined with our behavioral patterns. How we manage, spend, and save money directly impacts our financial well-being. By developing positive financial habits and consistently practicing them, we can aim for a stable and secure financial future.

Understanding the influence of our behavior on personal finance empowers us to make informed financial decisions and work towards financial freedom. Start today and take control of your financial destiny.